2019/10/28 星期一

AIDC日报由sdce.com.au赞助联合发布

AIDC最新资讯

统计显示全球超八成区块链专利在中国

2014年开始,区块链技术应用公司开始增多,到2017年进入创业高峰。如今中国的区块链技术,行业内公司实力已今非昔比,2018年中国区块链专利占全球的82.1%。据赛迪区块链研究院统计,2019年上半年中国公开的区块链专利数量为3547 项,已经超过2018年公开的全年专利总量2435项。

(新闻来源:巴比特)

知名投资人:纸币相比BTC真的只是“纸”币

2019年10月27日,第二届(2019)全球数字资产温哥华峰会在温哥华举行。全球知名投资人JeffreyWernick与会并发表演讲,他表示,纸币相比BTC就真的只是“纸”币,BTC是现有金融体系失败的结果。在通胀体系下BTC为良币,法币为劣币,因此会出现“劣币驱逐良币”现象,人们倾向于把良币存起来,把劣币花出去。所以BTC现在是价值储存而不是支付工具。

(新闻来源:币世界)

调查:超六成车企高管认为区块链将颠覆行业

据证券日报消息,近日,在IBM公司主导的一项调查研究表明,多达62%的车企高管认为,区块链将在三年内成为汽车行业的颠覆性力量,可以对改善汽车行业面临的信息摩擦点产生巨大影响。不过,值得一提的是,大部分受访车企高管对区块链的认识仍停留在大致概念上,至于何种区块链应用与车企密切相关且价值最大,多数高管仍缺乏具体的了解。

(新闻来源:币世界)

欧洲区块链中心主席:中国对区块链的高度重视值得欧洲学习

据钱江晚报消息,欧洲区块链中心主席罗曼·贝克表示,中国政府非常重视区块链技术,从政治、经济等全方位推进区块链技术,这对区块链的发展有着非常积极的作用,这也是欧洲需要向中国学习的地方。另外,中国以区块链为服务网络的目标和政策,计划把区块链的技术更多运用到公共事业部门,这个和欧盟的许多政策和服务有许多接近之处。

(新闻来源:币世界)

麻省理工和马来西亚学校合作开设央行运作课程 课程内容包括数字货币和区块链

据Cointelegraph.JP消息,马来西亚吉隆坡国际研究生院亚洲商学院(ASB)于10月1日与麻省理工学院(MIT)斯隆管理学院、及来自亚洲和美国中央银行的人员合作,建立首个有关中央银行运作的研究生课程。课程内容包含数字货币、区块链、货币政策、经济管理和人工智能。该课程计划于2020年5月启动。

(新闻来源:币世界)

观点:学术机构应在规范Libra方面发挥作用

多伦多大学罗特曼管理学院的创业加速器Creative Destruction Lab(CDL)是Libra协会唯一的学术创始合作伙伴。CDL与Libra的合作旨在通过为初创企业群体提供更多机会,巩固CDL的孵化作用。根据罗特曼管理学院教授和CDL首席经济学家Joshua Gans的说法,这种合作关系旨在为加入区块链领域的CDL初创企业提供更多机会。Joshua Gans表示,从长远来看,Libra为整个创业社区提供了一个机会。“在创造更好的创业生态系统的过程中,我们将完成我们的使命。”Gans还讨论了这种伙伴关系将如何造福于大学社区,“对大学来说,这是一个大胆的创新举措——一系列挑战通常不在大学的操舵范围内,但其领导层可以在这些挑战的基础上发展,并标志着超越日常学术生活的愿景。”罗特曼管理学院和UTM管理系金融学副教授Andreas Park在接受采访时表示,学术机构应在规范Libra方面发挥作用。

(新闻来源:金色财经)

人民日报官方微博科普区块链,强调区块链不等于BTC

人民日报官方微博28日早晨发表9图科普区块链。其中涉及区块链的特点有:1、安全;2、不可篡改;3、可访问;4、无第三方。区块链对未来的影响:1、不需繁琐个人证明;2、看病避免反复检查;3、旅行消费更加便捷;4、交易无需第三方。同时强调,区块链不等于BTC。BTC只是区块链技术的一种应用,区块链还有医疗卫生、食品安全、版权保护等诸多应用领域。

(新闻来源:币世界)

美国最大零售食品集团Topco Associates将利用万事达卡区块链技术追踪食品来源

据Cointelegraph消息,美国最大零售食品集团Topco Associates计划于10月27日测试由物流公司Envisible开发的可追溯性平台,在其运营中试用万事达卡的区块链技术,来追踪农产品、肉类和海鲜的来源。

(新闻来源:火星财经)

深圳将在前海全面推广电子发票,并根据实际业务不限量供应发票

记者10月27日从深圳市税务局获悉,深圳市税务局将在前海试点,全面推广电子发票,并于2020年1月1日起全面停止供应纸质增值税普通发票。对于使用区块链电子发票的企业,深圳税务部门将根据企业实际业务不限量供应发票。截至10月27日,深圳注册使用区块链电子发票的企业超过7500家,共开票975万张,涉及金额69.3亿元人民币(约合14.38亿澳元),涉及餐饮、零售、交通、住宿等多个民生领域。

(新闻来源:巴比特)

State Bank of India Chief Says Crypto Regulation Is a Must

The chairman of the State Bank of India (SBI) has spoken in favor of cryptocurrency regulation in an interview. He believes that it is necessary to regulate cryptocurrencies. Last week, the chairman attended IMF meetings in Washington, D.C., with Finance Minister Nirmala Sitharaman.

SBI Chairman Advocates for Crypto Regulation

State Bank of India Chairman Rajnish Kumar has reportedly argued for cryptocurrency regulation in India, despite the government considering a bill to ban all cryptocurrencies except state-issued ones. SBI, the largest bank in India and aFortune 500 company, is a government-owned corporation headquartered in Mumbai.

In an interview with PTI on Thursday, Kumar was asked about cryptocurrency. He replied, “the way the world is moving towards digitization, at some stage, a regulated cryptocurrency would be a better bet than an unregulated one,” the news outlet conveyed, and quoted him as saying:

Let’s see. Because there’s a dark side of the internet also. There can be misuse of the digital currencies. That is why regulation is [a] must.

The chairman added that efforts are being made to bring technologies like blockchain into the functioning of banks, the news outlet noted.

Kumar was in Washington, D.C., last week as part of the Indian delegation led by Finance Minister Nirmala Sitharaman at the annual meetings of the International Monetary Fund (IMF) and the World Bank. At the event, the finance minister and RBI Governor Shaktikanta Das talked briefly about cryptocurrency with respect to Facebook’s Libra digital currency project.

Meanwhile, the government of India has been deliberating on a draft bill to ban cryptocurrency which was submitted to the Finance Ministry back in February. The government has told the supreme court that this bill may be introduced in the next session of parliament. The court is scheduled to hear the writ petitions relating to this bill in January next year. Meanwhile, the supreme court is also addressing the banking restriction on the crypto industry by the central bank, the Reserve Bank of India (RBI). The hearing of this case is scheduled to resume on Nov.19.

Indian Banking Sector

As for the Indian economy and the banking sector, the SBI chairman said “Growth can comeback,” citing a number of reforms that have been implemented in the past three years. “And as a result, we are in a transition period. A lot of cleanup has happened in the corporate sector,” the chairman told PTI.

Kumar explained that the biggest challenge in the Indian banking sector revolves around the functioning of the public sector banks. He opined, “recapitalization has happened in a big way but sectoral issues need to be addressed like the power, road and telecom sectors,” adding that “These sectoral issues impact the working of the banks, particularly on the asset quality front.”

(新闻来源:Bitcoin.com)

UAE Accepts Crypto Regulation, Blockchain Projects Stand to Benefit

The Securities and Commodities Authority (SCA) in the United Arab Emirates has drafted a resolution on regulating crypto assets, providing greater clarity for crypto-related projects in the Middle East nation.

With the focus usually on China, Japan or the United States, the Middle East is an area that doesn't often get the attention it deserves when it comes to blockchain and cryptocurrencies. However, barring a few highly restrictive countries, such as Iraq and Kuwait, the region generally exhibits a very progressive and supportive stance when it comes to the blockchain industry.

Speaking to Cointelegraph, Sukhi Jutla, a blockchain author as well as a Financial Times and Google Top 100 European Digital Champion, commented that by drafting this resolution, the UAE is sending a positive sign to the world, adding that:

“They are signalling that they are open to exploring this area and by creating guidelines they are giving more reassurance, confidence and stability to businesses owners who may want to enter this field.”

This move by the UAE could potentially lead to other nations moving in a similar direction, which would help remove a lot of the obstacles that the industry currently faces. She went on, saying:

“The UAE has been smart enough to understand that this innovation will grow in years to come and they don’t want to miss it. I wouldn’t be surprised if the UAE becomes the leading nation in this space just as they did with the oil and property space."

While countries like Turkey, Iran and Israel are in the process of investigating the advantages of blockchain technology, the UAE, along with both Bahrain and Saudi Arabia, is leading the charge when it comes to positive crypto and blockchain legislation. The UAE, in particular, already hosts several blockchain initiatives that stand to benefit significantly from the new regulations.

The Digital Silk Road

The agreement aims to help drive progress of the Dubai 10X initiative, which hopes to digitize the trade process in what has become known as the "Digital Silk Road." Developed in collaboration with Dubai Customs and the cargo handling service DP World-UAE, the project is scheduled to go live in 2020.

The Bank Trust Network

The Dubai telecommunications service provider Du has partnered with Avanza Innovations to develop the country's first financial document exchange platform based on blockchain technology. The platform is built on Du's proprietary “Blockchain Platform as a Service,” a shared environment that was created last year to host blockchain-based proof-of-concepts put forward by companies hoping to adopt the technology.

National Bank of Fujairah joins Marco Polo

In September 2019, Dubai's National Bank of Fujairah (NBF) joined the international blockchain-based trade finance network Marco Polo. Launched in 2017, the network brings together some of the leading financial institutions and technology giants in the world, including Mastercard, Natwest, Microsoft, Oracle and Bank of America.

Etisalat and First Abu Dhabi Bank

In July 2019, the Abu Dhabi-based telecommunications giant Etisalat Digital partnered with First Abu Dhabi Bank and Avanza Innovations to develop a blockchain-based trade finance platform called UAE Trade Connect. Developer shope to leverage the immutability of blockchain technology to fight invoice fraud and eliminate the problem of double financing. So far, the project has managed to sign up several major Middle Eastern banks, including Emirates NBD, Commercial Bank of Dubai, Abu Dhabi Islamic Bank, Mashreq,Rakbank and Commercial Bank International.

Now, with favorable crypto legislation, are we are likely to see the UAE emerge as a leading blockchain nation in 2020? Miles Paschini, founder and director of crypto investment app B21, commented to Cointelegraph that:

“Clear regulation will enable this jurisdiction to be in a good position to become a regional leader. With this said, the devil is in the details, regulations can't stifle innovation. This will be a delicate balance of allowing innovation to occur while protecting consumer and sovereign interests."

(新闻来源:CoinTelegraph)

President Xi Says China Should ‘Seize Opportunity’ to Adopt Blockchain

Xi Jinping, President of the People’s Republic of China and General Secretary of the Communist Party of China, said the country needs to “seize the opportunity” afforded by blockchain technology.

Speaking as part of the 18th collective study of the Political Bureau of the Central Committeeon Thursday in Beijing, Xi said blockchain technology has a wide array of applications within China, listing topics ranging from financing businesses to mass transit and poverty alleviation.

“We must take the blockchain as an important breakthrough for independent innovation of core technologies,” Xi told committee members.

“[We must] clarify the main direction, increase investment, focus on a number of key core technologies, and accelerate the development of blockchain technology and industrial innovation.”

The Chinese president’s statements on blockchain are believed to be his first in-depth remarks on the technology.

Xi further said it would be “necessary to implement the rule of law network” into existing and future blockchain systems. To this end, Xi argued for a top-down approach concerning implementation, calling for guidance and regulation. Xi said testing of the tech should be widespread, including the investments in training platforms and “innovation teams” before implementation.

His speech also called for the creation of “Blockchain+,” a platform alluding to personal development such as education, employment and food and medicinal safety, among other basic needs.

Since a 2017 decision by the People’s Bank of China, cryptocurrencies are banned in the country, although a digital renminbi is being developed by the central bank and likely to launch soon.

(新闻来源:CoinDesk)

AIDC今日早行情

(数据部分来源 sdce.com.au)

10月28日BTC凌晨于14084.5澳元附近横盘调整,随后早间7时左右开始震荡上行,9时左右快速拉升,涨至14520.4澳元24H高点后回调。BTC现于14084.5澳元附近调整。主流币、四大平台币均普涨。

1. 全球数字货币市场总价值为3754.8亿澳元(+5.9%),24h成交量为1732.5亿澳元(-12.9%)。

2. 10月27日24小时资金流入前五个币种:BTC(+9,181.9万澳元)、ZB(+6413.5万澳元)、EOS(+1872.0万澳元)、TRX(+1616.6万澳元)、ETH(+1224.9万澳元);24小时资金流出前五个币种:CXC(-1396.8万澳元)、LINK(-306.2万澳元)、ABBC(-292.8万澳元)、BNB(-278.4万澳元)、USDT(-227.5万澳元)。

3. 主流数字货币表现如下: ETH暂报270.2澳元(+5.1%)、XRP暂报0.4澳元(+3.2%)、BCH暂报385.2澳元(+6.1%)、LTC暂报87.6澳元(+6.5%)、ETC暂报7.2澳元(+6.8%)、EOS暂报5.0澳元(+10.3%)。

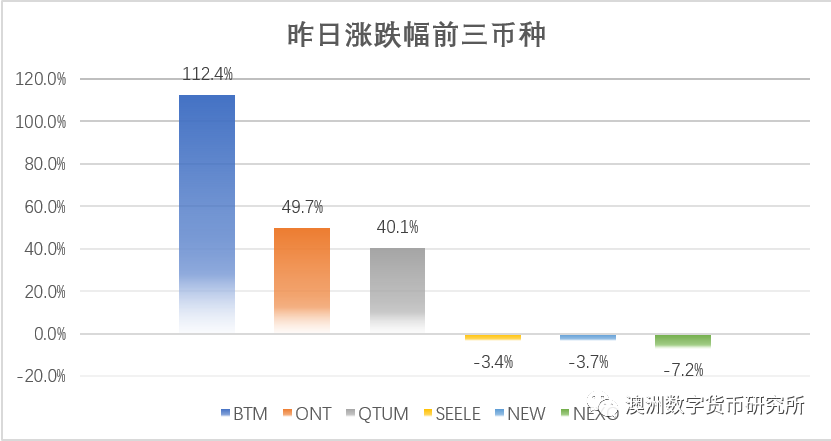

4. 24小时行情市值排名前百币种中,涨幅前三为:BTM(+112.4%)、ONT(+49.7%)、QTUM(+40.1%)。跌幅前三为:NEXO(-7.2%)、NEW(-3.7%)、SEELE(-3.4%)。

免责声明:本行情日报作为市场公开资讯,不构成任何投资建议。请读者谨慎参考。

AIDC澳洲数字货币研究所

联合SDCE数字货币交易所

助理研究员:Sherry Wang